FinTech is Fundamentally Adopting Blockchain

Blockchain in financial services is settling in and changing the game for good. Because of it our current markets’ infrastructure is evolving and different sectors are experiencing significant activity spikes, ranging from backend clearing and settlements to developments in the global capital markets architecture. There have been numerous distributed ledger systems implemented and some major financial institutions are even looking at establishing their own “private blockchains”.

Now we surely know that blockchain is more than just a data security protocol — it could very well rewrite the way we transact and do business in almost any industry.

The main reason blockchain is being adopted is its distributed infrastructure’s ability to share information that is secure and unalterable. This makes the technology an important tool in building trust among business and consumers who can access accurate data about transactions across nearly every financial service industry from retail banking and insurance to investment banking.

Companies have to understand when and how to utilize blockchain’s innate strengths – asset creation, asset transfer and data reconciliation – which will be crucial for them to emerge as winners as the financial services industry moves from exploration to direct application.

In this article we will explore how FinTech companies use blockchain technologies to take their game into the next level. According to a study published by Statista about blockchain usage among financial institutions worldwide in 2016, the majority was for international money transfers at about 60%. Other usages included, KYC (know-your-customer) and anti-money laundering, predictions and stock markets, collateral management, trade surveillance and more. Here we explore several of these applications that have been proven to unquestionably result into a competitive advantage for the players involved.

5 Competitor-crushing Applications for Blockchain In FinTech (With Examples):

1. Clearing and Settlement

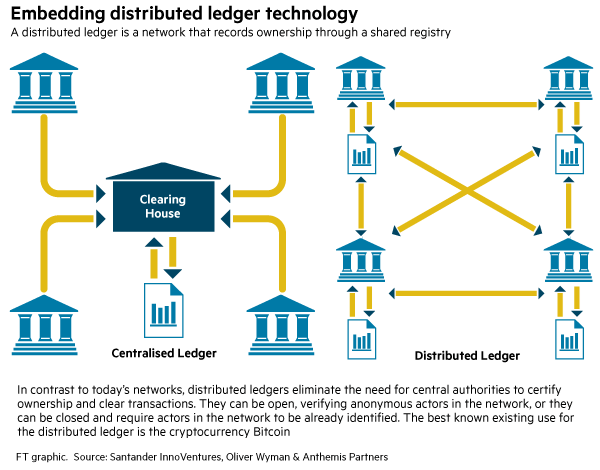

Financial organizations traditionally use a centralized process for their clearing and settlement procedures that rely on a middleman to facilitate. This means it can take up to weeks to clear a single transaction. FinTechs have to hold on to capital as collateral until these transactions clear. In other words, this is a perfect target for disruption with blockchain.

The distributed ledger technology provides trust & security without a middle man. The advantages of using it in clearing and settlement include:

- Reduced counterparty risk

- Eliminated unnecessary manual intervention

- Streamlined processes for confirmation

- Increased audibility, and transparency

- Freed-up trade capital not needed for collateral

Here is a simplified version of how it works:

Some people like Adam Ludwin, CEO of the blockchain startup Chain, have said that blockchain may even make clearing and settlement obsolete.

Regardless, FinTech institutions are already deploying blockchain-powered solutions to bring about fundamental improvements in their back office clearing and settlements.

Notable examples leading the way: SETL, Euroclear, Clear.

2. Trade Finance

For a long time trade finance has relied on slow procedures with paper-based, letters of credit transactions. Blockchain is radically transforming this sector by erasing current bottlenecks and streamlining all steps involved.

The technology could even increase global trade volumes to US$1.1 trillion by 2026, from the current level of US$16 trillion, according to a report by Bain & Company and HSBC.

Banks are already realizing these benefits through projects like We.Trade, a blockchain trade finance platform backed by nine major European banks. In fact here is a great graphic from Bain describing the current projects in this space:

3. Insurance

Blockchain is finding new applications in insurance every day. Its technological strengths are helping to reduce fraud, automate compliance and more. According to Accenture “33 percent of insurers are planning to use blockchain in the next two years, and another 36 percent of Insurers have already successfully used blockchain-based smart contracts for natural catastrophe swaps and created blockchain-based marine cargo insurance certificates.”

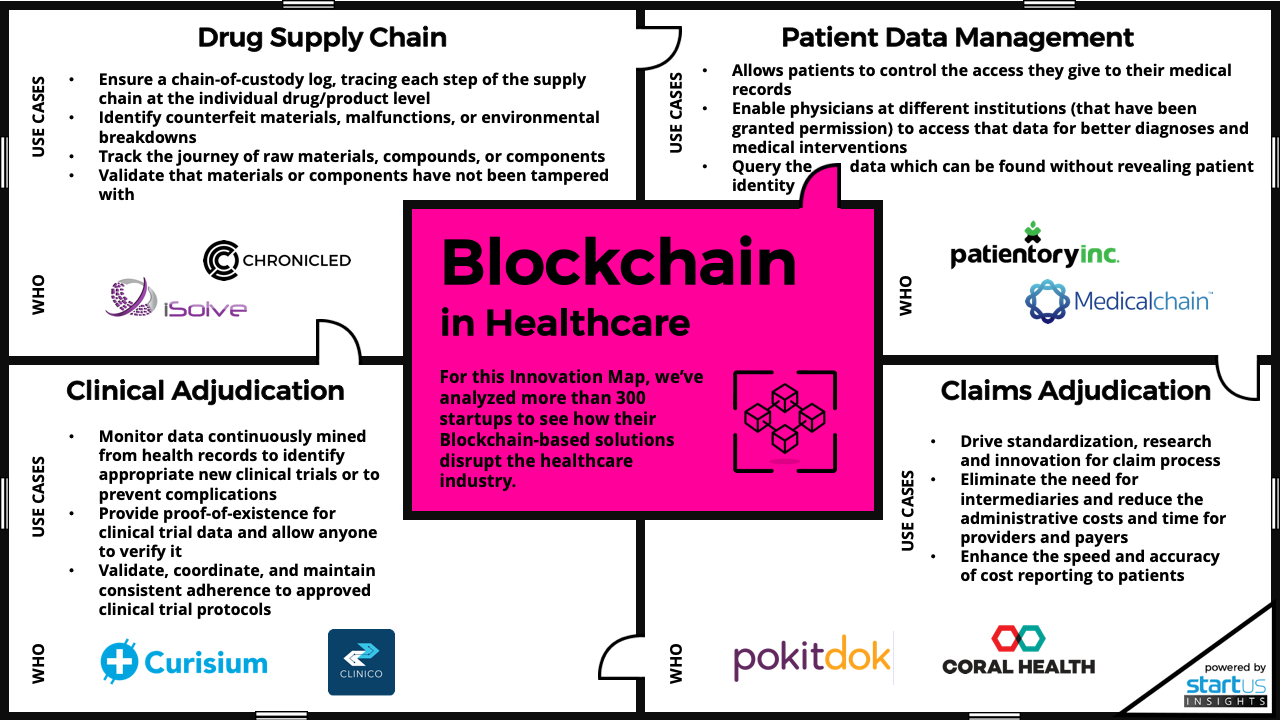

Here is a great graphic by Startus Insights that shows both the applications of blockchain in insurance and examples of companies leading the way in those fields:

How Blockchain Transforms the Insurance Sector (c) StartUs Insights

4. Decentralized Credit Scoring

There is a massive audience ignored by traditional banking methods when it comes to credit scoring. An estimated 1.7 billion adults and 160 million small businesses worldwide. These include:

- People living in rural areas;

- People with no checking or savings account (the unbanked);

- People with an account at an insured institution but who also use alternative financial providers (the underbanked).

These people are deprived of access to credit and blockchain is solving this by providing a new way of credit scoring. The Royal Bank of Canada is one example, having already developed and deployed a blockchain-based credit scoring system in partnership with JP Morgan. This application analyses more data sources and arrives at credit scores based on a complex set of identification data, historical data, and predictions about borrowers.

Examples of decentralized credit scoring companies: Colendi, Bloom, and Enigma.

5. Smart Loyalty Programs

Not only can blockchain help FinTech companies secure and streamline their operations,but it can also help them improve customer loyalty and reward systems. Using blockchain, companies can access wide variety of low-cost loyalty programs which they can customize to the specifics of their different customer groups.

Furthermore, loyalty campaigns launched with blockchain are completely transparent so firms can analyze at any time expenditures and ROI in detail. The convenience and satisfaction of customers is also greatly improved through reduced registration time. And since this is the main reason 70% of them never sign up, the addition of blockchain can unlock serious opportunities for growth.

Here are some examples of FinTech companies paving the way in this space: Loyyal, Qiibee. Interestingly Qiibee has a service to create a unique coin for their new clients.

Conclusion:

The blockchain technology may still be risky in some aspects, but it is definitely here to stay and reshape the global landscape for FinTech companies.

Better get ahead of the pack and start utilizing the fantastic advantages of what some have called the most exciting technology developed since the internet.

Once you can understand the potential of blockchain, where and how to apply it in your business, you can undeniably use it to push your competitors out of the way.

FinTech took us in a modern financial age and now with the addition of blockchain it could very well progress us to unseen before developments. The biggest advances are yet to come.